Save 1000 a Month Chart & Creative Tips to Start Saving

What could you do with an extra $1000 per month?!

Pay off debt, start an emergency fund, save for a vacation?

There is a lot you can do with an extra $1000 per month.

The problem is how do you take action and actually start saving?!

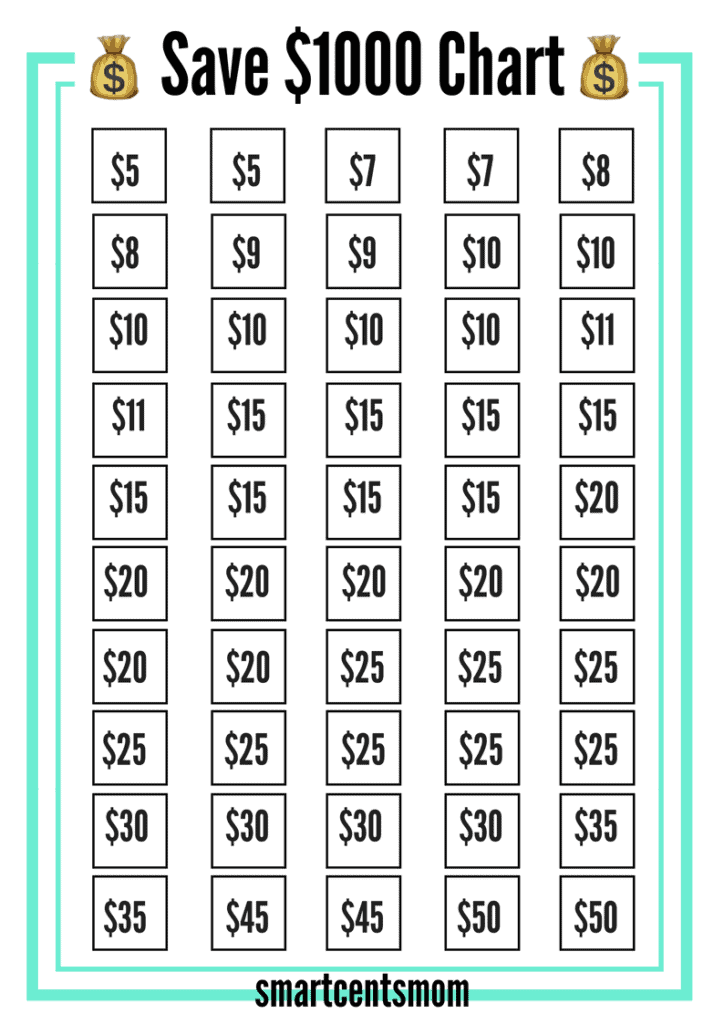

If your life is anything like ours…then it seems like there is never a good time to start saving 1000 dollars. What we need is a plan of action and a little motivation using this saving money chart: Save 1000 a Month Chart!

You can easily print out this Save 1000 a Month Chart printable to help you stay on track and meet your goal!

Start saving cash with these creative ways to save $1000 this month!

Money Saving Chart: Save 1000 a Month Chart

Use this FREE printable to save 1000 a month!

It’s super easy to use…

Just print out the save 1000 a month chart and each week mark off one box. We made this free savings money chart super flexible, so that you can save each week.

You don’t usually have extra money to save during the holidays or right after, so you may want to use those big savings numbers ($50, $40, $30) for weeks when your not spending a lot of extra cash.

Another creative way to save money using the save 10000 a month chart, we have given you 50 weeks to save $1000. That gives you 2 weeks of flexibility that you don’t have to worry about saving money!

Creative Ways to Save $1000 this Month

~ This article may contain affiliate links. I only suggest product or services I believe will benefit my readers. All opinions are 100% mine! ~

#1 Create a Budget to Save Money

Creating a budget will help you to know where your money is going and give you an idea of places you can cut back. The most common places to save money are groceries, shopping, and eating out.

Before you create a budget, start tracking everything you spend for a month. You might be surprised where your money is going. I didn’t realize I was spending over $100 per month at McDonald’s for my morning breakfast run on the way to work!

You can create a simple budget by writing down all your bills first. Set aside 10% for giving and 20% for savings. If you can’t meet the goal of 10% giving and 20% savings start with a lower percentage and work your way up to 10% giving and 20% savings when you are out of debt. The left over money will be for gas, groceries, and fun money (going out to eat, shopping, etc).

Telling your money where to go at the beginning of the month will help you save money throughout the month.

Places to Find Money Hiding in Your Budget

Subscription Boxes: There is a subscription box for everything! Literally, everything…for your dog, kids, crafts, clothes, food, gifts, workout clothes, jewelry, faith. If you’re not using the subscription, then this could be a great way to save some money.

Unused Memberships: Do you have a gym membership you don’t use? Do you use your Netflix membership? What about Spotify? Audible?

Garbage Removal: Take your trash to the dump yourself and save your money!

Landline Phone: We haven’t had a landline phone for 10 years! If you have a landline phone cancel your phone and just use your smart/cell phone.

Cancel Cable: You can cancel cable and replace it with Netflix, Hulu, or Amazon Prime to get tv shows and movies.

#2 Actually Save Your Savings with a Money Saving Chart

It can be so easy to turn your savings into spending more money.

Have you ever been shopping for a shirt, and then found an amazing deal? And then you think, now I can get some shoes too! And then there go your savings…

A money saving chart is a simple way to keep you motivated to keep your savings instead of spending it!

#3 Save Extra Cash with Survey Sites

Mintvine & Survey Junkie are my favorite survey sites to make some extra cash because they don’t waste my time! I can still earn points even when I don’t qualify for a survey with both of these survey companies.

This is the perfect way to use your down time…waiting in the car pick up line at school, doctor waiting rooms, sitting at kids’ soccer practice, binging your favorite Netflix shows…(you get the idea ????) to turn that time into extra cash with very little effort!

Sign up for Survey Junkie here!

You may also be interested in…

- Awesome Ways to Make Money without Paying Anything

- How to Make Extra Cash with Focus Groups Online

- Easy Ways to Earn Free Amazon Gift Cards

- Best Online Survey Sites {2019) to Make Money from Home

- Make $300 Dollars Fast Right Now!

#4 Save on Purchases You Already Made with this FREE App

Paribus is one of the easiest ways to save money if you shop online.

Many stores have a price match policy that allows you to receive a refund even after you purchased an item if the price drops. I know it sounds crazy, right?!

The thing is…not many people take advantage of it, because who has time to monitor prices, dig out the receipt, and fill out the refund papers?

That’s what makes Paribus so amazing! After connecting your email account Paribus will scan your email for receipts and check to see if there has been a price drop. You can even connect your Amazon account for faster refunds.

I don’t know about you, but I hate missing out on a good sale! Paribus helps you always get the best deals. You can read more in this Paribus Review.

Join Paribus Today and Start Saving!

#5 FREE Saving Money App with Trim

Subscriptions are one of the sneakiest ways to lose money in your budget each month.

Trim, a free money saving bot, saves you money by managing your subscriptions and negotiating your bills like cable and internet.

Just think how much you could be saving with the Trim app! Trim users have saved over $8 million dollars!

Click here to start Saving with Trim!

#6 Save on groceries

The grocery line item in your budget is one of the best and most difficult places to cut back and save. Sure you could eat beans and rice for every meal, but that will get old fast!

The good news is there are lot of ways to save on groceries, but it takes preparation and commitment to the grocery plan even on days you are too tired to cook.

Here are a few ways to keep you on track and saving money on groceries.

- Meal Planning: Meal planning is a great way to save money and time. You can plan by the week or by the month. You can plan days to eat out and base your meal planning on sales and deals you can get at the grocery store.

- Quick Recipes: Start a running list of recipes that can be made quickly. You could also try freezer meals, crockpot meals, and 30-minute recipes. Or my kids all-time favorite…breakfast for dinner!

- Shop ONCE a week: I shop once a week for our groceries. I noticed that every time I run back to the store for a couple of things I forgot I always end up picking up a bunch of other things. I usually add another $30 – $40 to my grocery spending each time I run back to the store!

- Shop the sales cycle: You can save money without using coupons by shopping the sales cycle. This is a great way to stock up on items you use regularly without paying full price.

- Grocery Pickup from Walmart: I am so excited about Grocery Pickup from Walmart. There are several grocery stores jumping on board the personal grocery shopper experience. This is a convenient and great way to save money while grocery shopping.

You also save money because you don’t end up buying anything extra than what is on your list. You can see the total of your purchase before you buy so you can make sure you are sticking to your budget. If they are out of an item they will upgrade you to a name brand or larger quantity item without charging you extra. The best part is the service is FREE and there is no tipping. This has saved me time and money!

#7 Money Saving Apps

Check out money saving apps. Some of my favorite apps to save money are Ebates, Ibotta, Shopkick, Savings Catcher through Walmart, Cartwheel by Target, and Checkout 51. These are great ways to save money on items you are already buying without using coupons.

Ibotta:

Ibotta is one of my favorite ways to save on groceries. You can save on produce, meats, dairy, eggs, and other name brand or store brand grocery items. All you have to do is download the Ibotta app, click on the deals you want, scan the products after you have purchased them, and scan the receipt.

Sign up for Ibotta and get a welcome bonus!

Ebates:

Ebates is another amazing way to save on purchases that you make online. One of my favorite things to do is purchase online from stores like Target, Walmart, or Lowes and then choose in-store pick-up. This will help you save money on purchases without paying for shipping!

You can sign up for Ebates here and get $10 just for signing up!

Shopkick:

Shopkick is a super easy way to earn free giftcards. You download the app to your phone and earn points just for walking into the stores. You can earn more points by scanning items on the Shopkick list. Some items qualify for more points if you purchase them and scan the receipt.

You can sign up for Shopkick here!

RELATED POST: 20 Ways to Save on Groceries without Using Coupons

#8 Use Cash

Use cash to help you stay within your budget. The great thing about cash is once it is gone you can’t keep spending. Cash helps you to be more aware of how much your spending. When I have cash to spend I always think twice before making a purchase.

#9 Brown Bag Lunch

Pack your lunch to save some money! You can meal prep on Sunday and be ready for the rest of the week. You might even lose some weight like I did when I cut out my McDonald’s (breakfast) run!

#10 Negotiate Your Fixed Bills

Have you ever tried calling to see if there are any ways you can get a better deal on fixed bills like cable, internet, cell phone contracts, electric/water bills, credit card debt, or financial loans?

You may not be able to get much money off your bill, but it doesn’t hurt to ask. For example, we weren’t aware that our electric company offers a deal that you can choose to pay the average monthly price of your bill. Over the course of the year we are paying the same amount which helps us to budget better. If there is anything left over we receive a check back at the end of the year.

Even if you don’t get a lower monthly payment, each company may be able to offer you advice on ways to lower your bill.

#11 Use Coupons

Coupons can save you money especially when you know how to use them. Some coupon tricks can really pay off:

- Stack store coupons with manufacturer coupons

- Use coupons on items that are on sale

- Pay attention to the sale cycle of grocery items

- Use digital coupons

Southernsavers is a great place to find deals for couponing. I’m not a coupon queen, but Southernsavers makes it easy to find deals quickly to save money. They have tons of tutorials and weekly lists of sales with matching coupons.

#12 Open a new bank account

You can open a new bank account and make $150 just for opening a new account with a direct deposit. We receive offers from 3 different banks monthly to do this! There is a lot of competition for your money right now.

#13 Clean out closets and sell your stuff

You can sell your used stuff on eBay, Facebook, Craigslist, or even Amazon.

Some of the best advice I have found is to sell through Amazon as an Amazon FBA Business. I love the tips given in this FREE Amazon FBA Business video seriesLook around your home and see if you can find any items that you haven’t opened yet that you could sell for over $15. I hope to try this in the near future since I have a few toys that I had bought at Christmas last year and forgotten about. I also had a couple of gifts that I hadn’t opened and from family members that I could sell.

#14 Rent out your space or your stuff

Do you have an extra bedroom? Opening your home to a roommate could easily earn you $200 a month. We live in a college town and there are always people looking for somewhere to live for a brief amount of time. We have an extra guest bedroom that is already furnished and perfect for renting out. We rent to people who have been referred to us through friends or family.

Now you can rent out other stuff:

- baby gear: strollers, car seats, pack’n play

- bicycles

- parking spot

- clothing

- cars

What other ways do you have for saving $1000?

You might be interested in these ways to earn extra money:

5 Ways to Make $500 – $1000 per Month

Ultimate List of Survey Sites that Pay with Paypal

7 Ways for Busy Moms to Make Extra Money Online

[…] Should I travel or save money?! Your daydreams of sinking your toes into warm sand, feeling a warm breeze on your face, […]